All you need to know about rents and service charges including what they're for and how they're calculated

For this video to work, you will need to enable the cookies on this website. You can do this by updating your cookie settings at the bottom of this page.

Alternatively, you can watch the video on YouTube here.

How much will my rent increase by?

From April 2026, we will be increasing our rents by 4.8% following the Government’s guidance for social landlords.

This increase is calculated based on the rate of inflation (September 2025 Consumer Prices inflation rate of 3.8% + 1%).

We have written to all our residents to explain what this means for you and to set out clearly how much your new rent will be from April 2026.

Why is my rent going up?

Like all social landlords, we follow the Government’s guidance on the rents we charge each year.

Our social rents are on average the fourth lowest in the country, and while we appreciate any increase is difficult, our social rents will continue to remain amongst the lowest – and at least 50% lower than the cost of renting a similar property from a private landlord.

Our affordable rents on some homes built in the last 15 years are at least 20% lower.

PCH works hard to make sure our rents remain affordable for local people.

We need to increase rents to help us meet the increased costs involved in keeping our homes in good repair, making any necessary improvements, managing tenancies, and building more affordable homes, so that we can meet the needs of local people both now and in the future.

We know that your home is important to you, and we can confirm that your rent goes back into providing good quality affordable housing and supporting the communities we work within.

How is my rent charged?

Your rent is charged on a weekly basis and is due weekly in advance.

This year payments are due from 6 April 2026 to 4 April 2027.

If you choose to pay fortnightly, your payment will need to cover the current week and week following. You can also pay monthly in advance. We check your account at the end of each week.

How is my rent calculated? Information for shared owners

Your lease sets out how rent increases are calculated. If your lease states the Retail Prices Index (RPI) plus 0.5% is used, Plymouth Community Homes has calculated the increase by using the Consumer Prices Index (CPI) rate of inflation in the previous September plus 1% each year. This provides a lower increase than if we use RPI so using this index is to your benefit. PCH have used the same calculation if your lease states CPI + 1%.

What are the dates for the rent year?

Our rent year runs from 6 April 2026 to 4 April 2027.

How many rent payments are there in the year?

If you pay weekly, we ask you to pay your rent for the whole year over 52 weeks so that you will have two rent-free weeks.

If you pay your rent by monthly Direct Debit, your rent for the year is paid in 12 equal instalments.

However you pay, the total for the year will be the same.

When are the rent-free weeks?

There are two ‘rent-free weeks’ which will be the weeks starting 28 December 2026 and 29 March 2027.

Will I still get my free weeks if my rent account is in arrears?

If you are in arrears, have a court order or have another arrangement in place to clear arrears, you will still be expected to make payments during the rent-free weeks.

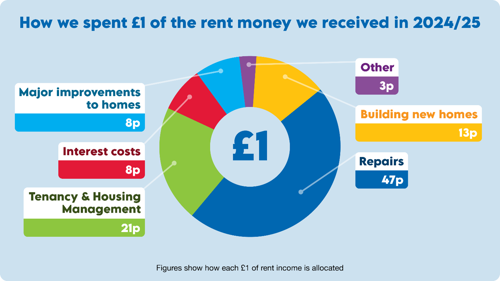

What is my rent used for?

Your rent is used to manage, maintain and improve your home, strengthen your community and help fund the building of new homes.

What is a social rent?

A social rent is based on a Government formula which takes into account the number of bedrooms, together with local wages and the open market value of the property.

PCH social rents are about 50% cheaper than renting the same property from a private landlord.

Service charges (if applicable) are charged separately.

What is an affordable rent?

An affordable rent is higher than a social rent, and is inclusive of service charges. Affordable rents are charged on most properties built after 2010, but they are still around 20% to 30% cheaper than renting from a private landlord.

We set our affordable rents using Government guidance which says that when they are relet they can be charged at up to 80% of the rent for equivalent property let by a landlord in the private market (inclusive of any service charges).

What if I fall behind with my rent or service charges

We understand that you might be worried about your rent, especially if you are struggling cost-of-living pressures.

Residents still need to continue paying their rent, but if you’re struggling, it’s important that you let us know as soon as possible so we can try to help.

The sooner we know, the sooner we can work to find a solution for you.

If you need help, please contact the Income Recovery and Financial Inclusion Team as soon as possible on Freephone 0800 028 0350 or (01752) 388121.

Money worries, especially debt, can have longstanding effects on your health, as well as having wider implications for you and your family. We work with several agencies that can help you resolve your problems in complete confidence.

Our teams can also help with applications for benefits, advice on Government support available to help with cost-of-living rises and energy costs, and other financial aid that you may qualify for, as well as debt advice.

Last year we supported hundreds of people to resolve their debt problems, access benefits they were entitled to, or source financial support.

If you are worrying about money and paying your rent, please contact us as soon as possible.

How can I get help with my rent and service charges?

If you have a low income and do not get any help to pay your rent at present, you may be entitled to Housing Benefit or Universal Credit.

If you are of pension age and would like to make an application for Housing Benefit you can do this online at https://www.plymouth.gov.uk/benefitsandgrants/housingbenefit or by contacting Plymouth City Council on 01752 668000 or by speaking to our Income Recovery and Financial Inclusion Team on Freephone 0800 028 0350 or (01752) 388121.

If you are of working age you will need to apply for Universal Credit which replaces a range of working age benefits and Tax Credits to simplify the system and make work pay. To find out if you can make a claim, and for the latest information, visit, www.gov.uk/universal-credit or speak to our Income Recovery and Financial Inclusion Team on Freephone 0800 028 0350 or (01752) 388121.

I am receiving Housing Benefit. Do I need to reapply?

If you receive housing benefit now and you live in Plymouth, you do not need to reapply.

You will receive a letter from the Housing Benefit Office that will tell you your new benefit entitlement and the revised amount you should pay each week.

If you receive housing benefit now and live outside of Plymouth, you do not need to reapply but you do need to let your local Housing Benefit Office know how much your new rent is going to be.

They will then let you know your new benefit entitlement and the revised amount you should pay each week.

Before receiving Universal Credit

If you start claiming Universal Credit there will be a delay of around a month before your regular payments arrive, known as the waiting period - as Universal Credit is paid monthly in arrears. We advise keeping 4 weeks' rent credit on your rent account to provide a financial cushion.

I am receiving Universal Credit. Do I need to reapply?

If your housing costs are paid for by Universal Credit, please keep your PCH rent notification letter somewhere safe as you will need it in April.

In April, you will be sent a ‘to do’ communication called 'Confirm your housing costs'. Please use the information in your PCH rent notification letter to complete the ‘to do’ request before the due date to avoid problems with your Universal Credit payments.

You must only use the 'Confirm your housing costs' to-do to report these changes. Do not contact Universal Credit to report them any other way.

Paying by Direct Debit

Direct Debit is the best way to pay your rent. Direct Debit is safe and easy which is why almost 55% of our residents now choose to pay this way.

If you set up a Direct Debit you are protected by the Direct Debit Guarantee.

You can pay weekly, fortnightly, four weekly or monthly on any date you choose.

These payments should be made in advance in line with the terms of your tenancy agreement.

For more information or to set up a Direct Debit, contact us on Freephone 0800 028 0350 or (01752) 388121.

For this video to work, you will need to enable the cookies on this website. You can do this by updating your cookie settings at the bottom of this page.

Alternatively, you can watch the video on YouTube here.

What is a service charge?

Service charges are the amount you pay for additional landlord services not covered by the rent, such as caretaking and the maintenance of grounds and communal areas, including grass cutting and cleaning.

Service charges are needed to share the cost of providing services to areas used by residents. These are mainly for the communal areas and grounds but for some residents, service charges also include TV services and individual heating provided by a communal heating system.

Your service charges are based on the actual costs of the service we provide to your home, and PCH does not make a profit on service charges. We only cover our costs. Full details of the amounts you pay are set out in your service charge statement which is enclosed if your home has such charges.

What services are covered?

Services included in the charge could be things like

- Window cleaning

- Bin cleaning

- Maintaining your building

- Looking after the area around your building

- Grass cutting

- Hedge trimming

- Cleaning stairwells

- Providing laundries

- Keeping the building clean, tidy and safe

- Shared on-site facilities, like community rooms

- Managing specialist equipment, like lifts

- Communal lighting

Plus the cost of managing and administering these services

How do we work out service charges?

We operate a variable service charge system, and we only charge you the actual amount it costs us to deliver the services you receive. This means we do not make a profit from service charges

We aim to provide services in the most reasonable and cost-effective way and to a high standard.

Service charges are equally applied to all homes and residents who receive or benefit from the same services.

Why are you sending out a service charge statement?

The service charge statement shows you the difference between the actual costs, compared to what we originally estimated for the period October 2024 to September 2025. This period is called the ‘look back period’.

At the same time, we then estimate how much your service charge will be for the following 12 months. By law, if we make this charge, we must make an adjustment when we know how much the services actually cost. We want to be open and transparent with you about these costs and the adjustment.

The estimate might be different from the actual cost due to things like changes in inflation or different products being used to provide services. Once we know the actual cost, we either add or deduct the difference from the estimated cost of the services for the next year (starting April 2026) to give your new service charge.

What is the ‘look back period’ and how does this work?

Every year in September, we look back over the previous year to see what it actually cost to provide services to you.

We look at the period from October in the previous year, to September in the following year, so we get a full 12 month’s costs.

We then check if it cost more, or less, than the amount we originally estimated.

If services cost more, we will add the difference onto your service charge for the next year’s services. If they cost less, we will deduct the difference from your service charge for next year’s services.

At the same time, we estimate costs for the coming year – which runs from 6 April 2026 until 5 April 2027.

We send your service charge statement (covering the adjustment for October 2024 – September 2025) along with our estimate for the following year (covering April 2026 – March 2027) in your rent notification letter.

All annual charges start from April, unless a new service is introduced during the year.

Why are my service charges changing this year?

We operate a variable service charge system, and the cost of providing services are calculated annually, so a range of factors influence why a service charge may change from year to year.

For example, some residents have a communal heating system to heat their home which means they have a service charge for heating.

PCH negotiates energy costs with suppliers to get the best possible price but if prices increase, we have to reflect this increase in the service charge.

Costs can also increase if someone uses more gas than we originally estimated they would.

This year, the majority of our service charges will be increasing by an average of 3.6%.

Individual increases vary depending on where you live and which services you receive.

In our sheltered homes where residents pay for personal services such as individual heating, the majority of supported housing residents (51%) will see their service charges go down by an average of 26.5%, primarily due to a national reduction in gas prices.

For other sheltered residents not paying for these services, average service charges have increased overall due to increased costs for delivering these services.

The majority of social rent tenants will see an increase in their service charges due to increased labour and staffing costs for PCH in delivering services, as well as water utility costs rising by up to 50%.

Tenants will see a detailed breakdown of their service charge in the individual notification letters sent in February.

Will I get a refund if I am owed money for the period October 2024 to September 2025?

If we over-estimated your service charge for the look back period, any extra money we have charged you will be taken into account by reducing your service charge for the year starting from April 2026.

Why should I pay for a lift, laundry or door entry control in my block if I don’t use them?

If you live in a block of flats with communal services, everyone in the block has access to the facilities. Whether you choose to use it or not, all residents in the block share the cost of communal services and the cost is shared between all properties in the block.

I am in a block and I know someone in another block who pays a different amount for the same service. Why is this?

Each block, however similar, will have costs that can vary. For example, one block may have more flats than another, so the costs are shared among more residents. This makes the cost per resident lower. Some blocks have more grounds to maintain or larger courtyards to clean, so the service charge may be higher.

What is a management charge in my service charges?

There is a cost in running and managing the services provided to your block. These costs are covered by the management charge.

This includes calculating the charges and adjustments, managing the contracts, making payments to our contractors and suppliers, providing information and consulting with residents.

The management charge equates to 22p per service, per week, and is never more than 15% of the total cost of your service charges.

What is my support service charge?

The Support Charge is a charge that tenants of Housing with Support schemes pay to cover the cost of support, including staff who manage the scheme and provide support services.

Charges may be different for individual tenants and how long someone has held their tenancy in supported housing. It will also be dependent on whether tenants are eligible for part funding by Plymouth City Council, (if in receipt of eligible state benefits), or eligible for transitional support toward their charge from Plymouth Community Homes.

If you live in supported housing and have queries about your Support Charge, your Housing with Support Officer is available and can provide further advice and support.

There is also a separate support charge for those residents with personal alarm systems in their supported housing bungalows. We consulted with residents during 2025 about increasing this charge. Your rent letter gives more information about the outcome of this and the increase from April 2026.

Why is my service charge for supported housing changing?

Residents in our sheltered housing schemes will see a £2 a week increase in their support charge if they started their tenancy before April 2023.

This continues the policy agreed with residents three years ago to steadily increase charges each year until the full cost of the service is met.

Residents who started their tenancy from April 2023 already pay either the full charge, or a reduced charge if they are on a low income and in receipt of council funding. They will both see a 4.8% increase in their charges in line with the percentage rent increase.

Residents living in some of our supported housing bungalows fitted with care alarms whose tenancy started before April 2025 will see an increase of £1 per week for their alarm charge. This follows the consultation exercise we conducted with residents back in the autumn. Residents who started their tenancy after April 2025 will see a 4.8% increase in their charge from £4.70 to £4.93 per week.

Your rent letter provides further information on these changes.

Information for tenants and leaseholders who pay a service charge for gas or electricity in communal areas

Many of our residents pay for communal gas and/or electricity as part of their service charge. Unlike the utilities within your home, the energy for this is not covered by the domestic price cap set by Ofgem, so we are required to source the energy commercially. Energy prices can change significantly over a short time and we have to act fast to secure the best possible price.

Normally, we would issue a Section 20 consultation letter (Section 20 of the Landlord and Tenant Act 1985) to let you know we are looking to secure new energy, however, this can take three months to complete which could mean that we miss out on a competitive price.

To ensure we can secure the best prices and value for money, we have applied to the First Tier Tribunal (FTT) for Dispensation (to be exempt) from the Section 20 process. The Tribunal will decide whether we can comply with the requirements of Section 20 or not.

The Tribunal requires that we make tenants and leaseholders aware of this application and inform you of your right to support or oppose this.

Please note this is for the supply to communal areas only and will not affect individual utility contracts you have within your property for your own gas or electric supply.

If you are unsure whether this applies to you, check your service charge breakdown to see if you pay a charge for communal gas or electricity. You can do this through your MyPCH account.

If you would like to respond to the application in accordance with the directions, please email us.